Home Buyer Alerts

Client is a first-time or repeat homebuyer who is preparing to enter the market.

Monitoring Contacts to Find Hidden Loans

Our proprietary technology gives LOs exclusive pre-market opportunities by highlighting clients who are likely to start a loan within the next 90 days, getting them ahead of the competition.

Predictive Scenario Alerts break down into seven different categories:

Client is a first-time or repeat homebuyer who is preparing to enter the market.

Homeowners who are likely preparing to sell their property soon.

Homeowners who are good candidates and could benefit from tapping into their home equity to access cash.

Clients who could benefit from adjusting their mortgage rate or term to improve their financial position.

Burrowers who are eligible to remove Mortgage Insurance (MI) based on equity and payment progress.

Clients interested and eligible in purchasing a second home or vacation property.

Senior homeowners who may benefit from converting their home equity into cash flow through a reverse mortgage.

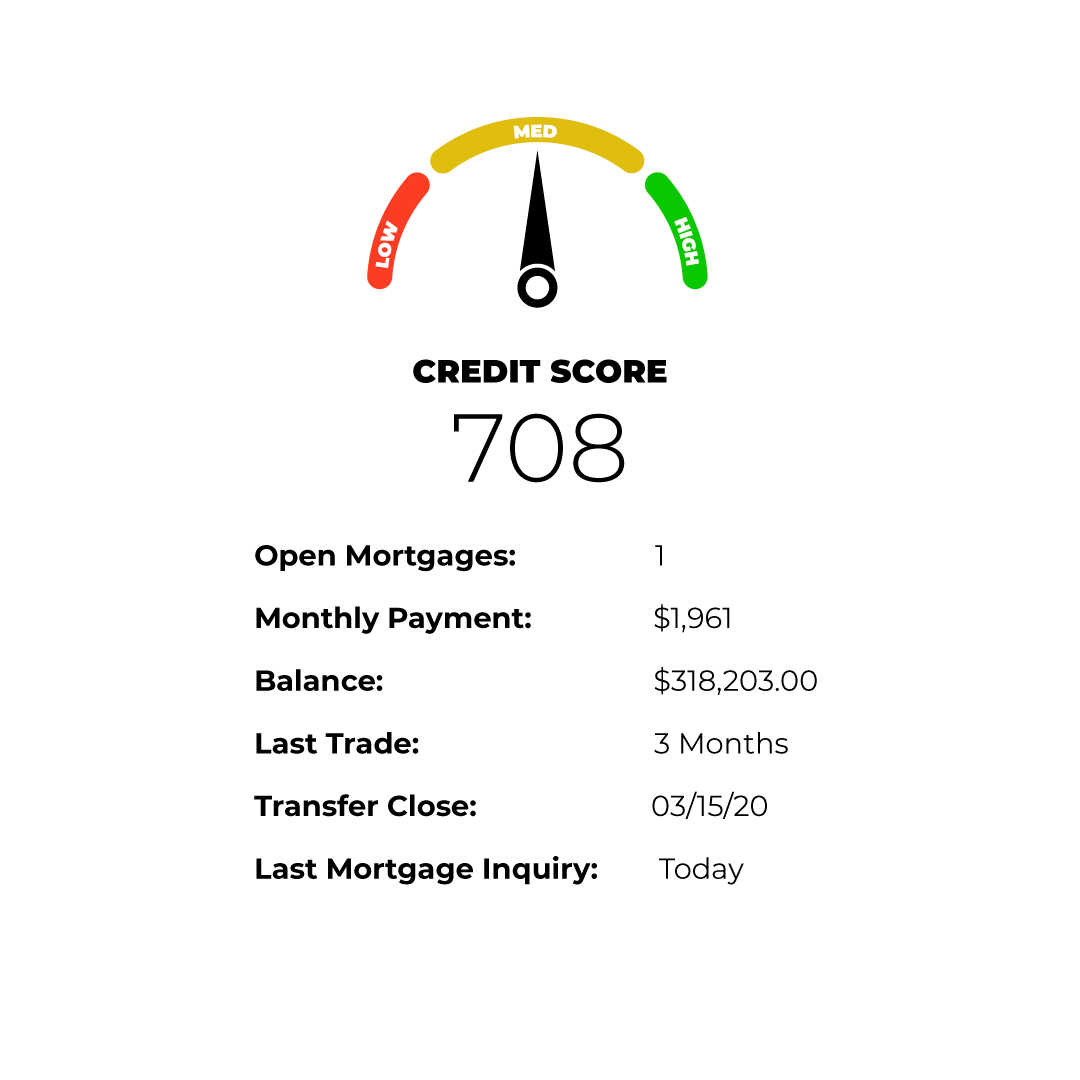

Mortgage Loan Officers will instantly know when their customers or prospects are inquiring about getting a new mortgage with a competitor.

One of your contacts are shopping for a mortgage with a competitor.

A contact or past client is entering the housing market.

A client is actively shopping in their early payoff period.

Mortgage loan officers can be the heroes who help them when their credit qualifies and walk them through every step of the buyer journey.

One of your contact's credit score has improved to meet your minimums.

A contact's BK has met seasoning requirements.

The contact's mortgage payment history has improved.

A former contact's credit file is now scoreable.

Maybe they are ready to sell their home and stop wasting money on rent. Engage customers ready to move.

Contact in your database has listed a property for sale.

One of your contact's addresses is listed for rent.

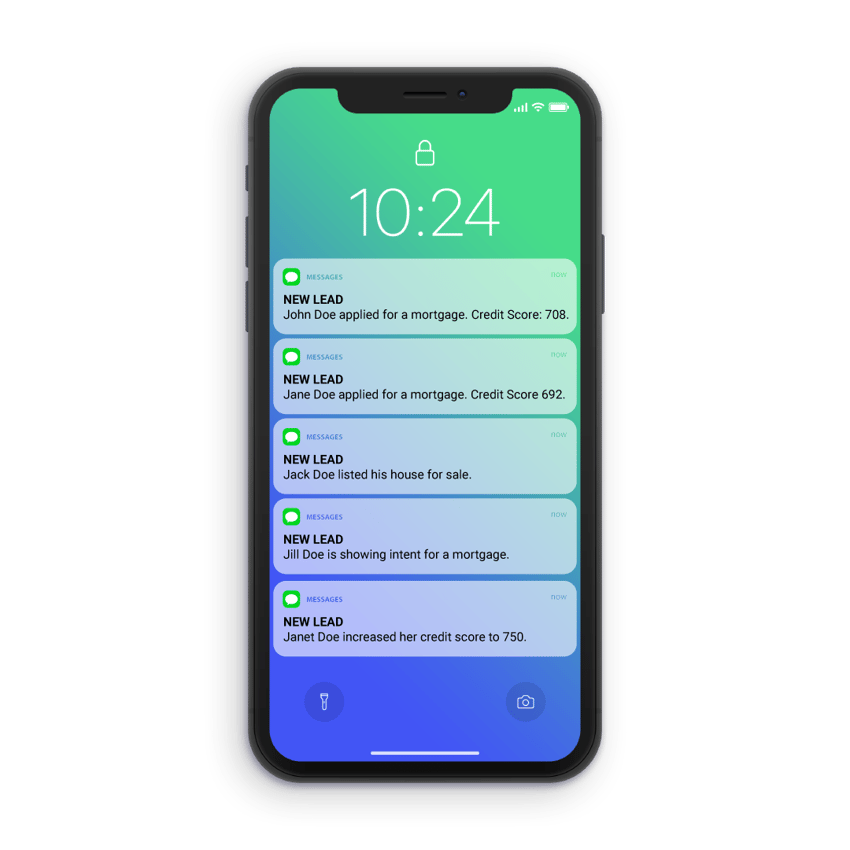

Our technology constantly scans your database of customers, contacts, leads, realtor databases or past clients.

We notify you when any of those contacts are ready for a mortgage transaction. We notify you of anyone who: just applied for a mortgage, improved their credit, listed their home for sale, or hundreds of other proven data points that predict the most likely homebuyers.

We automatically send high converting email and direct mail offers of credit on your behalf which generates a consistent stream of inbound calls and emails… so you don’t have to spend so much time doing cold outreach and prospecting.

We send mortgage leads (ALERTS) right to your inbox on a daily basis so that you can reach out in person and increase the effectiveness of your marketing.

With SoftPull*, you can give your customers a way to start the process and get credit pre-qualified right from their phone.

* MonitorBase SoftPull Feature is for inquiring about customers' credit criteria for mortgage qualifications. No other credit criteria apply.

"We absolutely love SoftPull and offer it to every single one of our referral partners! They truly see the value in it and we find it is one thing that really sets us apart from the other companies. SoftPull is the best. =)"

"MonitorBase's expertise in getting me in contact with the appropriate borrowers is priceless. Also, their ability to notify me when my past clients are back in the market has been awesome!"

"Was able to connect with two clients that have pulled credit recently, and help them with what they needed, that I wouldn't have otherwise even known they were looking at financing."